Quaderno is a versatile tool for managing invoices. It helps businesses with their accounting needs.

Using Quaderno in English can streamline your financial processes. This powerful platform offers features like automatic tax calculations, multi-currency support, and effortless integration with various payment gateways. By understanding its functionalities, you can better manage your sales, tax compliance, and customer invoicing.

Whether you are a small business owner, freelancer, or an enterprise, Quaderno provides an efficient solution for your accounting requirements. Dive into this blog post to explore how Quaderno can simplify your financial management and help you stay compliant with tax regulations, all while using English as your primary language.

Introduction To Quaderno

Quaderno is a powerful tool for businesses. It helps manage invoicing, taxes, and reporting. Small businesses and freelancers benefit greatly from it. It simplifies complex tasks and saves time.

What Is Quaderno?

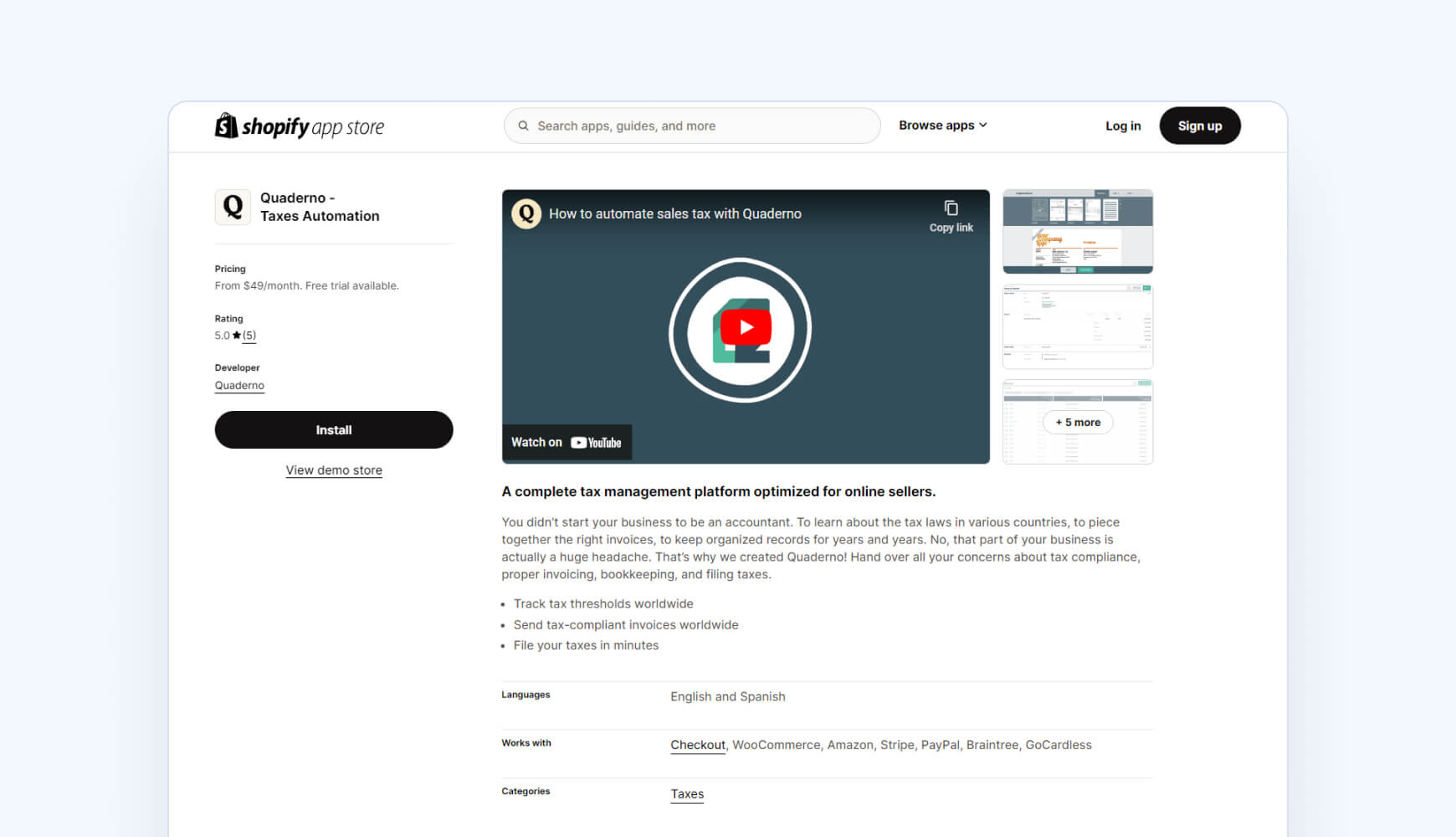

Quaderno is an online platform. It automates invoicing and tax management. It calculates taxes based on customer location. It creates compliant invoices and sends them automatically. It tracks sales and generates detailed reports. It integrates with popular payment gateways and e-commerce platforms.

Importance Of Multilingual Invoicing

Quaderno offers multilingual invoicing. This is essential for global businesses. Customers prefer invoices in their native language. It builds trust and reduces misunderstandings. Multilingual invoices enhance customer experience. They also ensure compliance with local regulations.

Credit: goodereader.com

Setting Up Quaderno

Setting up Quaderno is simple. It allows you to manage taxes with ease. This guide will help you create an account and configure your preferences.

Creating An Account

First, visit the Quaderno website. Click on the “Sign Up” button. Fill in your name, email, and password. Confirm your email address. Log in to your new account. You’re ready to start.

Configuring Language Preferences

After logging in, go to the settings. Find the language options. Choose your preferred language. Save your changes. Your Quaderno account now uses your selected language. This makes it easier to manage your tasks.

Creating Multilingual Invoices

Creating multilingual invoices can be a daunting task. Quaderno simplifies this process. It allows businesses to generate invoices in multiple languages. This feature is essential for companies operating globally. It ensures clear communication and avoids misunderstandings with international clients.

Choosing Languages

Quaderno supports various languages. You can select the language that suits your client’s needs. This feature ensures that clients receive invoices in their preferred language. It enhances the customer experience. It also makes your business appear more professional and considerate.

Customizing Invoice Templates

Quaderno offers customizable invoice templates. You can tailor these templates to match your brand. This includes adding your logo, adjusting colors, and modifying layout elements. Customizing invoices helps maintain a consistent brand image. It also makes the invoices more appealing and easier to understand for clients.

Managing International Clients

Managing clients from around the globe can be a daunting task, but with Quaderno, it becomes a breeze. This platform simplifies the intricate process of handling international clients, ensuring all your invoicing, tax, and compliance needs are met. Let’s delve into some of the key aspects that make managing international clients with Quaderno so effective.

Adding Client Information

Adding client information in Quaderno is straightforward and intuitive. Here’s a simple guide to help you get started:

- Navigate to the Clients Section: Go to the ‘Clients’ tab on your dashboard.

- Click on ‘Add New Client’: This button will open a form where you can input all necessary details.

- Fill in the Details: Enter the client’s name, email, address, and other relevant information.

Having all client information in one place ensures that you can easily access and manage it whenever needed. Plus, it makes generating invoices and tracking payments a lot simpler.

Handling Different Currencies

Dealing with clients from different countries means handling various currencies. Quaderno supports multiple currencies, making transactions seamless and accurate. Here’s how you can manage different currencies:

- Select the Right Currency: When adding a new client, choose their local currency from the dropdown menu.

- Automatic Conversion: Quaderno automatically converts amounts based on the current exchange rates, saving you the hassle of manual calculations.

- Currency Reports: Generate reports to see how much you have earned in each currency, helping you keep track of your global income.

These features ensure that you can manage your international clients without worrying about currency conversions and discrepancies. It’s like having a personal accountant who works round the clock!

In conclusion, Quaderno offers a user-friendly solution for managing international clients. By simplifying tasks like adding client information and handling different currencies, it allows you to focus on what you do best – growing your business. So why not give it a try and see how it can make your international client management smoother and more efficient?

Automating Tax Compliance

Tax compliance is a critical aspect of running a business, but it can be a daunting task. Keeping up with ever-changing tax laws, calculating taxes accurately, and ensuring timely payments can be overwhelming, especially for businesses operating in multiple countries. This is where Quaderno comes in. With its advanced features, Quaderno automates tax compliance, making the process straightforward and hassle-free. Let’s dive into how Quaderno simplifies this complex task.

Understanding Global Tax Laws

Global tax laws are a maze of rules and regulations that can confuse even the most seasoned business owners. Each country has its own set of tax laws, and they can change frequently. Keeping up with these changes is crucial to avoid penalties and ensure compliance.

Quaderno is designed to stay up-to-date with the latest tax laws around the world. It automatically updates tax rates and regulations, so you don’t have to worry about keeping track of them yourself. This means you can focus on running your business, knowing that Quaderno has your back when it comes to tax compliance.

Automatic Tax Calculations

Calculating taxes accurately is essential to ensure that you’re collecting the right amount from your customers and paying the correct amount to tax authorities. Manual calculations can be time-consuming and prone to errors, leading to potential fines or overpayments.

Quaderno takes the guesswork out of tax calculations. It automatically calculates the correct tax rates based on the customer’s location and the type of product or service being sold. This ensures that you’re always compliant with local tax laws and that your customers are charged the correct amount.

Here’s a quick overview of how Quaderno’s automatic tax calculations work:

- Detects customer location: Quaderno identifies the customer’s location through their billing address or IP address.

- Applies correct tax rate: Based on the location, Quaderno applies the appropriate tax rate for that region.

- Generates tax reports: Quaderno generates detailed tax reports, making it easy to file tax returns and stay compliant.

With Quaderno, you can rest easy knowing that your tax calculations are accurate and up-to-date, freeing up your time to focus on growing your business.

Automating tax compliance with Quaderno not only saves you time and reduces errors but also ensures that you’re always on the right side of the law. So why not let Quaderno handle the complexities of tax compliance while you focus on what you do best?

Integrating Quaderno With Other Tools

In today’s fast-paced business world, efficiency is key. Integrating Quaderno with other tools can save you time and reduce errors. Imagine having your accounting software, payment gateways, and other essential tools working seamlessly together. Let’s explore how you can make this happen.

Connecting To Accounting Software

Keeping your finances in order is crucial, and Quaderno makes it easy by connecting to popular accounting software. Whether you use QuickBooks, Xero, or another tool, integration is straightforward.

- QuickBooks: Sync invoices and expenses directly from Quaderno to QuickBooks. This eliminates double-entry and ensures your records are always up-to-date.

- Xero: Just like QuickBooks, Xero integration allows for seamless data transfer. Your financial data is organized and accessible in one place.

This integration means no more manual entry errors. Plus, you can focus on growing your business instead of getting bogged down by paperwork.

Using Payment Gateways

Accepting payments is a breeze with Quaderno. It integrates with major payment gateways to simplify transactions for you and your customers.

- Stripe: Automatically create invoices and receipts for every transaction. Quaderno handles taxes and compliance, so you don’t have to worry about a thing.

- PayPal: Many customers prefer PayPal for its convenience. Quaderno’s integration ensures that every PayPal transaction is recorded accurately.

These integrations help streamline your payment process, making it faster and more efficient. Your customers get a smooth experience, and you get accurate records without the hassle.

In conclusion, integrating Quaderno with your accounting software and payment gateways can transform how you manage your business. It saves you time, reduces errors, and ensures compliance. Why not give it a try and see the difference it makes?

Tracking Payments And Receipts

Managing finances can be a daunting task, especially if you’re not a native English speaker. But fear not! Quaderno makes tracking payments and receipts a breeze. Let’s dive into how you can effortlessly monitor invoice status and generate financial reports with Quaderno.

Monitoring Invoice Status

Keeping tabs on your invoices is crucial to ensure you get paid on time. With Quaderno, you can easily monitor the status of your invoices. Here’s how:

- Real-Time Updates: Quaderno provides real-time updates on your invoices. No more guessing if an invoice has been paid or not.

- Easy-to-Read Dashboard: The dashboard is straightforward and user-friendly. You can quickly see which invoices are paid, pending, or overdue.

- Notification Alerts: Get notified as soon as an invoice is paid. This way, you stay on top of your finances without constant checking.

Imagine this: you send out an invoice, and within minutes, you receive a notification that it’s been paid. How convenient is that?

Generating Financial Reports

Financial reports are essential for understanding your business’s financial health. Quaderno makes generating these reports simple:

- Customizable Reports: Create reports that fit your specific needs. Whether it’s monthly, quarterly, or yearly, you have the flexibility.

- Comprehensive Data: The reports include all the necessary details. From total income to expenses, everything is covered.

- Export Options: Need to share your reports? Easily export them in various formats like PDF or Excel.

Here’s a little secret: generating a financial report with Quaderno is so straightforward, you’ll wonder how you ever managed without it. Plus, it’s a great way to impress your accountant!

So, whether you’re monitoring your invoices or generating detailed financial reports, Quaderno is your go-to tool. It simplifies the process and helps you keep your finances in check. Give it a try and see the difference for yourself!

Credit: taxcloud.com

Best Practices For Multilingual Invoicing

Multilingual invoicing can be a challenge for businesses with international clients. Quaderno simplifies this process. It ensures invoices are clear and compliant in any language. Here, we discuss best practices for multilingual invoicing with Quaderno.

Maintaining Consistency

Consistency in multilingual invoicing is crucial. Ensure all invoices follow the same format. This helps clients recognize and understand them. Quaderno allows you to set templates. These templates maintain uniformity across different languages.

Use the same terminology in all languages. This reduces confusion. Translate key terms accurately. For example, “Invoice” should be the same in every language version. Quaderno provides translation features. This ensures consistent terminology in each language.

Ensuring Accuracy

Accuracy is vital in multilingual invoicing. Errors can lead to misunderstandings. Double-check translations for correctness. Quaderno’s translation tools help ensure accurate language use. Inaccurate translations can affect client trust. It’s important to get it right.

Also, ensure all financial details are correct. This includes amounts, dates, and tax information. Quaderno automatically calculates taxes. This reduces the risk of errors. Accurate invoicing builds client confidence and professionalism.

Common Challenges And Solutions

Quaderno simplifies tax compliance for global businesses. Yet, businesses face common challenges. These challenges can hinder smooth operations. This section discusses solutions to these common issues.

Overcoming Language Barriers

Businesses often deal with international clients. Language differences can cause misunderstandings. Quaderno offers multi-language support. This feature allows businesses to communicate effectively. Documents and invoices can be created in multiple languages. This ensures clear communication with clients.

Resolving Currency Issues

International transactions involve various currencies. This can complicate financial management. Quaderno supports multiple currencies. Businesses can create invoices in any currency. It automatically converts amounts to the base currency. This simplifies accounting and financial reporting.

Future Of Multilingual Invoicing

The future of multilingual invoicing is bright. Businesses are expanding globally. This expansion demands efficient invoicing in multiple languages. Quaderno is at the forefront of this shift. It offers tools that simplify this complex process.

Emerging Trends

Multilingual invoicing is growing. The demand is clear. Companies need to cater to diverse markets. Invoicing in multiple languages helps build trust. It also ensures accuracy. Customers appreciate invoices in their native language. This trend will continue to rise.

Technological Advancements

Technology plays a crucial role. Quaderno leverages modern tech for multilingual invoicing. Automation is key. It reduces human error. It also speeds up the process. Machine learning helps in translating invoices accurately. This ensures consistency and reliability.

Integration with other systems is seamless. Quaderno connects with popular platforms. This makes the invoicing process smoother. Businesses can focus on growth. They don’t need to worry about invoicing issues. Quaderno handles it efficiently.

Credit: shop.needlenthread.com

Frequently Asked Questions

What Is A Quaderno?

A quaderno is an Italian notebook or journal used for writing, drawing, and organizing thoughts.

What Does Quattro Mean In English?

“Quattro” means “four” in English. It refers to Audi’s all-wheel-drive system.

What Is Il Quaderno?

Il quaderno is an Italian term meaning “notebook. ” It refers to a book used for writing, drawing, or note-taking.

What Is The Plural Form Of Quaderno?

The plural form of “quaderno” is “quaderni. “

What Is Quaderno?

Quaderno is an online tool for managing taxes and invoices. It helps businesses with tax compliance.

Conclusion

Quaderno in English simplifies business tasks. It helps manage invoices and taxes. Easy to use, it saves time. Clear and user-friendly design makes it accessible. Perfect for non-native speakers. Using Quaderno ensures accuracy and efficiency. Try it to streamline your business processes.